Every person who uses banking services or applies for a loan eventually hears about credit scores. They often come into play when you decide to buy your first home, secure a new credit card, or even rent an apartment. Most lenders and financial institutions have obligations to provide information about these scores. You may wonder why, when, and how this information reaches you. Let’s take a closer look at situations that trigger the need for rights explanations and score transparency.

Situations That Lead to Disclosure

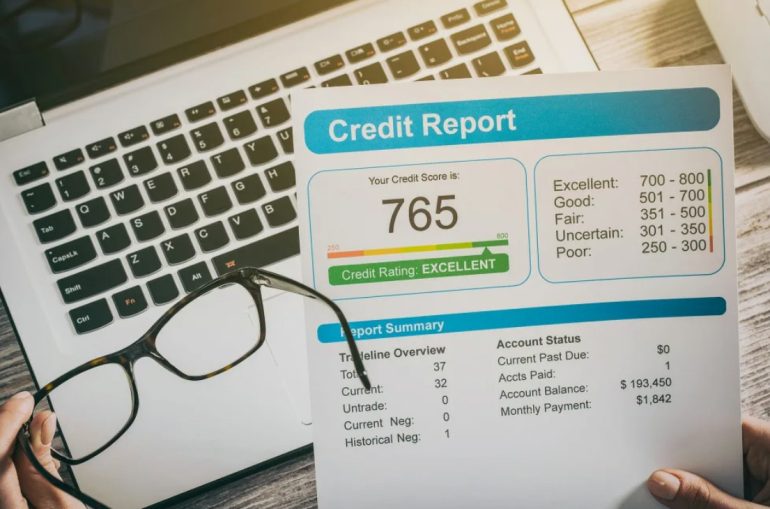

Whenever a consumer applies for new credit, lenders evaluate their financial history. This review is based on data that includes payment records, existing debts, and other financial behavior. If the application is denied or approved with unfavorable terms, the applicant must receive a notification containing certain score details. Notification is required in cases like mortgage approval, car purchase financing or changes to existing credit accounts. There are specific situations where providing information about the score becomes a legal responsibility.

Common Scenarios:

- Credit card applications and approvals

- Rejection of loan or credit requests

- Changes to interest rates on existing accounts

- Employment decisions when credit information is considered

- Rental agreements with credit checks

Did you know? Some landlords check applicants’ scores before renting out an apartment. If the decision hinges on your report, you have a right to see relevant information used.

In day-to-day life, such moments can impact not only financial opportunities but also housing and career choices. Businesses, recruiters, and landlords are expected to maintain transparency when credit histories play a part.

Laws and Norms Shaping Disclosure Practices

There are established rules and legal standards that underpin these practices. Today’s regulatory landscape sets responsibilities for financial institutions. Both national and local bodies require that consumers be notified any time their score impacts a major decision. This includes informing individuals of the score used and, if applicable, how it was calculated. Providing such details offers protection and transparency, letting people understand their financial standing and how decisions are made.

Why is This Needed?

Giving people access to their data helps prevent mistakes and unfairly denied requests. Errors can be corrected on time, and individuals are empowered to address negative factors. Notification also promotes trust between lenders and the public. The standards for these practices have evolved — in our time, regulations aim to ensure rights, fairness, and clarity.

Tip: Review all communications from banks or lenders carefully. Always check if the score and explanation are provided when denied credit or offered higher rates.

Rules vary by country and by type of decision being made. Still, the underlying purpose is to allow every consumer access to the details that influenced financial outcomes.

Other Situations and Useful Insights

Disclosure may also be necessary in less obvious cases. For instance, when accounts are reviewed for ongoing risk, or when significant changes are made to credit terms. Even automated systems trigger the same notification if your financial data plays a role in the decision process.

Insurance companies, for example, might review scores to decide on policy rates. Employers in sensitive industries sometimes investigate an individual’s financial standing before hiring. All these scenarios meet the requirement to share relevant details about credit history use.

- Requesting a copy of your report is always allowed, and you should exercise this right regularly.

- Regulations demand that the notification be clear, concise, and easy to understand, so you’re never left in the dark.

In today’s world, digital technologies ease the process. Notifications often arrive electronically, instantly alerting you about decisions and your data’s role in them.

Understanding when Credit Score Disclosures Are Required helps protect your finances and promotes fairness. Multiple situations can prompt notification, from applying for credit to renting a home or seeking employment. Laws demand transparency and clear communication, allowing each person to react, dispute or plan based on the information received.